Charitable Remainder Unitrust

A charitable remainder unitrust offers maximum flexibility with regards to the investment and benefits of your gift plan.

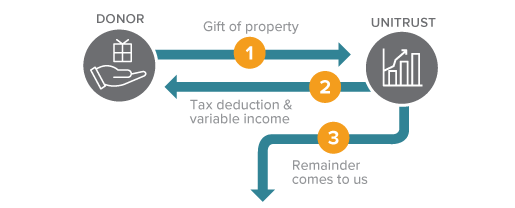

How It Works

- You transfer cash, securities, or other appreciated property into a trust. The required minimum for this type of gift is $100,000.

- The trust pays a percentage of the value of its principal, which is valued annually, to you or beneficiaries you name.

- You may use your real estate to fund a charitable remainder unitrust (CRUT), which may be structured to provide lifetime income for you and/or others, or income for a term of years.

- When the trust terminates, the remainder passes to United Way of the Greater Lehigh Valley in support of their overall mission.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no up-front capital gains tax on appreciated assets you give.

- You may be able to make additional gifts to the trust as your circumstances allow for additional income and tax benefits.

Next

- More detail about Charitable Remainder Unitrusts.

- Frequently asked questions on Charitable Remainder Unitrusts.

- Related Gift: Charitable Remainder Annuity Trust.

- Contact us so we can assist you through every step.

“Giving through United Way provides us with a simpler and more structured way to support the charities and organizations we believe in.”

Paul and Rebecca Francis

Tocqueville Society Members

Leadership Circle spotlights

-

Nearly 1,500 Volunteers UNITE to Transform the Valley in a Single Day of Service at United Way’s 32nd Day of Caring, Presented by Crayola

Volunteers from 60 companies and organizations kick off the 2025 United Way campaign during Lehigh Valley’s largest, single-day volunteer effort.

-

15 Years of Impact: Why the Pessinas Choose to Give Back

Member spotlight: Michael and Michele Pessina have supported United Way for over 15 years, driven by a shared belief in giving locally. Their passion for education, children and lasting impact continues to shape a stronger Lehigh Valley community.